Employee Discount Programs:

Best Questions to Ask

If you're a business owner or HR professional tasked with evaluating an employee discount program for the first time, you may find the process to be a bit daunting.

How do you compare programs? What are the factors you should consider? Why do some programs charge while others don’t? Which program is best suited to meet the needs and unique demographics of your workforce? How do you know which programs are likely to succeed?

Don't fret, because we've got your back with this official guide to comparing employee discount programs.

When evaluating employee discount programs, it's important to ask these questions. Any reputable employee discount provider will gladly provide you with these answers.

Question #1: “Who are the merchant providers in your discount network?”

This is where most employers start when evaluating employee discount programs. So, how familiar am I with these brands and, more importantly, will my employees be familiar with them too?

Keep an eye out for brands that have a strong national presence like Costco and Target, restaurants like Olive Garden and Red Lobster, service providers like Verizon and T-Mobile, and theme parks like Disneyland and Walt Disney World. These well-known brands instantly bring credibility, even if they may not be the ones your employees use most frequently.

Keep in mind: not every brand offers discounts. Brands like Walmart, Whole Foods, or Amazon typically don't use promotional offers because it goes against their business strategies.

That’s why employers also need to consider the discount selection from local merchants in and around their own communities, which brings us to our next question:

Question #2: “How many merchants are LOCAL?”

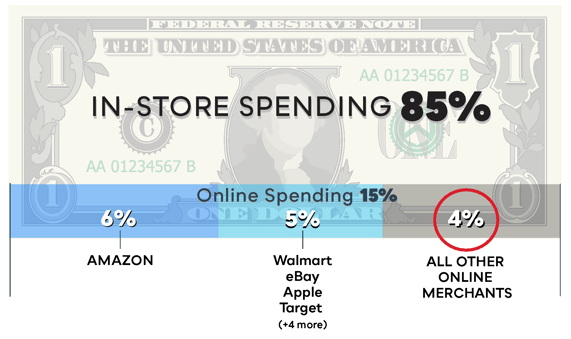

Even though online purchases have become more popular in the last 20 years, they still only make up a small fraction - less than 15 percent - of the discretionary purchases made by U.S. consumers.

That's right. 85% of all consumer spending happens offline. At a physical, brick-and-mortar location. Like restaurants, department stores, gas stations, auto shops, hair salons, movie theaters – just to name a few.

However, it's important to note that the majority of online purchases are made on popular websites like Amazon, Apple, eBay, and Walmart.com, which do not offer discounts through external discount programs. They primarily limit their discounts to their own websites. As a result, of all the other online stores out there, only a small percentage of retail sales, - less than 4% - occur at these online merchants. If your discount program only offers online deals, then that program will be irrelevant for 96% of your employees' everyday purchases.

So, make sure you ask your discount program:

- What percentage of their merchants are transacted online vs. in-store?

- How many participating restaurants are near the office where they go for lunch?

- Who are the most popular retailers nearby... in the communities where your employees live and work?

- Where can your employees go to have fun nearby, like movie theaters, theme parks, golf courses, museums, etc.?

These are the places where employees spend the most money, and where your discount program will have the most impact.

Question #3: “How PRIVATE are your offers?”

Have you ever had someone tell you “you’re special,” only to discover they say the same thing to everyone they meet? That’s what it’s like offering publicly available discounts to employees and calling them benefits.

These kinds of discounts are typically made available through what are called “advertising networks,” where retailers offer a small commission to websites that help them drive product sales.

However, these free employee discount programs rely on using the same publicly available offers found on websites like FatWallet and Slickdeals. In order to generate maximum sales commission, they need a large audience, which means employers are just one of many advertising channels they utilize.

Unfortunately, this approach leads to a perception of low value, low employee engagement, and the increased risk of presenting advertisements as benefits to employees.

Question #4: “How DEEP are the discounts?”

To truly gauge the value of your employee discount program, it's important to consider the size of the discounts being offered, and whether those offers are private or public.

To gain a comprehensive understanding of the program's overall value, ask these questions:

- What is the average percentage discount across all offers?

- What percentage of merchants offer BOGO (buy one, get one) deals?

- How many merchants offer discounts of less than 10%?

These factors will help you determine the true worth of the program and its impact on your employees' wallets.

At Access Perks, for example, our average discount is right around 31%, with most merchants offering at least one BOGO offer. Virtually none of our providers offer a discount of no less than 10%.

Question #5: “How RELEVANT are the discounts?”

Don't misunderstand me. Services like ID theft protection, tax preparation, and laser eye surgery definitely have their value. However, they are not the types of purchases that people make on a daily basis. Therefore, discounts on these services are often seen as less relevant by employees, unless they find themselves in need of them.

Instead, look for employee discount programs that offer savings on purchases your employees make most often. Here’s a look at the top spending categories that comprise the average American’s household budget, according to U.S. Census:

- Retail shopping: 16%

- Dining: 14%

- Automotive: 11%

- Consumer services: 9%

- Recreation & Entertainment: 7%

When evaluating employee discount programs, it's important to assess how well each program caters to the spending categories that matter most to your employees. Since dining is a daily occurrence for most people, it's crucial to inquire about the number of participating nearby restaurants. Additionally, consider if the program offers grocery coupons and discounts on clothing for both adults and children. It's also worth asking if there are discounts available for electronics, kids' toys, cell phone plans, dry cleaners, movie theaters, and fitness centers. By focusing on these areas, you can ensure that the program aligns with your employees' needs and preferences.

Click here to download a detailed checklist of some of the most common consumer spending categories. Use it to find out how well they’re represented in employee discount programs you evaluate.

Question #6: “How EASY is it for employees to redeem discounts?”

In the good old days, snagging a discount was as simple as cutting out a coupon from the newspaper and presenting it at the store. But times have changed, and now there's a wide range of "promotional offers" available, each with its own level of ease or difficulty when it comes to redemption.

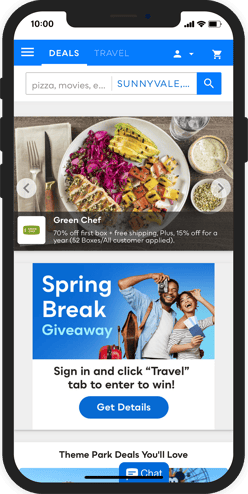

Mobile coupons are a must-have in today's fast-paced, wireless world. Customers want to save money on the go, and the convenience of redeeming offers right from their smartphone or mobile device is unbeatable.

The true beauty of mobile coupons is that they can be instantly redeemed at the cash register, making the entire process seamless and hassle-free. When evaluating an employee discount program, be sure to ask how many offers can be redeemed through mobile devices and how many physical locations or storefronts accept them.

Other common discount redemption methods include:

- Print-and-go coupons

- Promotion codes for in-store, online and telephone purchases

- Online booking of travel-related services

- Direct purchases of discounted merchandise like movie passes, concert tickets and gift cards

The downside to online purchases, as mentioned earlier, is that they only represent a fraction of consumer purchases. In-store purchases like dining, groceries, auto care and other everyday services overwhelmingly comprise the majority of household spending. Even gift cards, which technically can be used in store, often go unused by consumers when making purchases on their own behalf.

Question #7: “What about your CUSTOMER SERVICE?”

When it comes to any workplace benefit, you’re going to get questions from employees. The same holds true for even the best employee discount programs. Without dedicated customer support, the calls and questions still come. They just go to YOU.

Be sure to ask: what kind of customer service can we expect for our employees? Is there someone they can call, or do they send their requests via email? If support is provided by telephone, is it provided toll-free or do we pay additional per-minute charges? If email, how often is the account checked for new submissions? What are the service department's hours of operation?

At Access Perks, for example, we include toll-free telephone service and live webchat support as a standard part of every package. The purpose is to answer questions and provide technical assistance, allowing the employers and employees we serve to remain focused on their jobs.

Question #8: “What will you do with our employee data?”

As with most benefits, employee discount programs typically require a basic level of personal information sharing with the employer. Such information allows the program to authenticate qualified users, as well as to communicate relevant information about the benefits in a timely fashion. You need to be sure that’s all they’re doing with that data.

As previously mentioned, discount programs that are, in fact, “advertising networks” generate their revenue by driving sales volume to merchant partners. The resulting pressure can lead to frequent and irrelevant “spam” email promotions sent directly to employee email boxes. Be sure to find out what your provider’s policy is as it relates to employee communications, both in terms of frequency and content.

Another way that free employee discount providers earn revenue is by selling your employees' data to the highest bidder. Ask them point blank, how can you ensure that my employee data will only be used for this discount program only, and not for any other marketing purpose? Request a copy of your provider’s data and privacy policy and have a qualified attorney review it to make sure there are no hidden caveats that allow them to sell your data.

Question #9: “What’s the cost?”

Ah! For many businesses and HR departments, this is indeed the question.

Pricing options for employee discount programs can vary widely, from no-cost plans to upfront balloon payments. In determining total cost, find out which of the following buckets each program falls into:

- “Free.” Typically these are programs that seek out the largest employers in pursuit of the greatest possible advertising reach and sales commissions. (To learn more about such programs and how they work, see above or refer to the report: “Free Employee Discount Programs: 10 Secrets You Should Know.”)

- Fee-based. Billed on a monthly or quarterly schedule, fee-based employee discount programs base their rates on the number of employees enrolled. Ask about volume-based price breaks as well as pricing options for basic and premium discount content.

- Less popular in recent years, hybrid plans are both “paid” programs in that they charge a one-time access fee and “free” in that no additional fees are paid thereafter. The access fee is most frequently charged by advertising networks to smaller employers whose size makes them otherwise unlikely to generate commissionable volume for the discount provider.

Remember to ask about other costs like setup fees or charges for custom requests. These may include asking the provider to recruit businesses you refer and including discount providers you already have relationships with.

Question #10: “How long are we locked in by contract?”

Unfortunately, not all partnerships are meant to last forever. It's important to know the duration of your contractual commitment with the provider in case you decide to discontinue their services. Will it be for one year? Three months? Or perhaps just one month? Furthermore, does the contract automatically renew once the term ends? If it does, be sure to inquire about the notice period required to terminate the relationship without being billed for the next period.

Other Questions That May Be Worth Asking

Since every organization is different, here are some additional factors you may want to consider when shopping for the best employee discount programs:

- Can offers be used more than once?

- Can the program be branded on behalf of your organization?

- Can you integrate discount providers with whom you already have relationships into the program?

- How easy is it to add and subtract employees (and are there any charges or limits on doing so)?

In Short…

However you choose to proceed, don’t take the decision lightly. When it comes to the most compelling employee perks / lifestyle benefits, the best employee discount programs can stretch your staff’s paychecks by hundreds, even thousands of dollars while engaging them in a benefit they can use every day.

Avoid wasting your employees' valuable time or jeopardizing their trust by providing them with a program that consists primarily of low-value, ho-hum ads.

Evaluate prospective providers thoroughly. Ask direct questions and expect clear, comprehensive, and transparent answers. (See: "Is Access Perks Worth It?") By doing so, you'll not only improve your chances of finding an excellent program but also a reliable partner. Look for someone who is dedicated to treating your employees as well as you do.